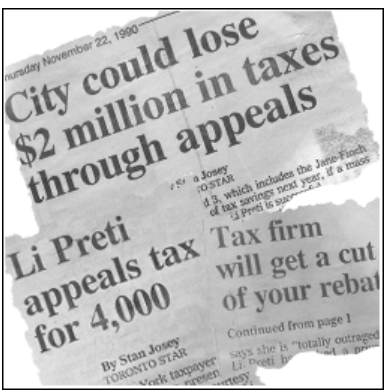

Dr. Li Preti was the first politician in the city to initiate a ‘large scale’ challenge to property assessments. This resulted in more than thirty-five hundred successful tax appeals within the ward. Since that time, the province has implemented Actual Value Assessment, and this, on the heels of Councillor Li Preti’s initiative, has resulted in a tax reduction for more than 80% of single-family residences in Ward 8.

Many other former North York residents received unprecedented refunds on their municipality property taxes, courtesy of Councillor Peter Li Preti. When Councillor Li Preti appealed assessments on every single house and condominium in his area, people on the government side were appalled. “He became a legend when he appealed the taxes on all the houses in his ward…”(The Toronto Star) “Nobody had ever tried to get assessments reduced on an entire city area before. It was not easy and was also risky business. The Assessment Review Boards could have looked at the figures and those homes which were under assessed and were not paying enough, the assessments could have increased. People in the property tax bureaucracy still shudder when Peter Li Preti’s name is mentioned. However, he showed that there are so many inequities in the system that neighbouring and almost identical houses could have wildly differing assessments. Finally the assessment department acknowledged the wild differences in assessment value and reduced the assessments of 3500 homes in Li Preti’s ward.”(The Toronto Star)

Councillor Li Preti consulted with many residents in his pursuit to implement M.V.A. The councillor organized meetings all over the city to inform residents about the benefits and disadvantages of such exercise. Above Councillor Li Preti responded to residents in the St. Augustine’s area.

| Councillor Li Preti participated in a protest rally in front of Queen’s Park in favour of the full value assessment debate. The councillor was able to bring together residents from all over the city. Thousands of residents protested bitterly against the retention of M.V.A. and continued to fight the issue until the Province forced the City to implement the program in 1998. |

Councillor Li Preti was the first councillor in the GTA to launch a massive tax appeal against the assessment department. Councillor Li Preti consulted with residents in his ward on property taxes. In the end he successfully reduced over 3500 assessments on residential homes with millions of tax savings for the community.